In 2019, personal income tax revenue represented 24% of total tax revenue in OECD countries. Countries tax labor income in a variety of ways through payroll taxes, personal income taxes and, in some cases, surcharges.

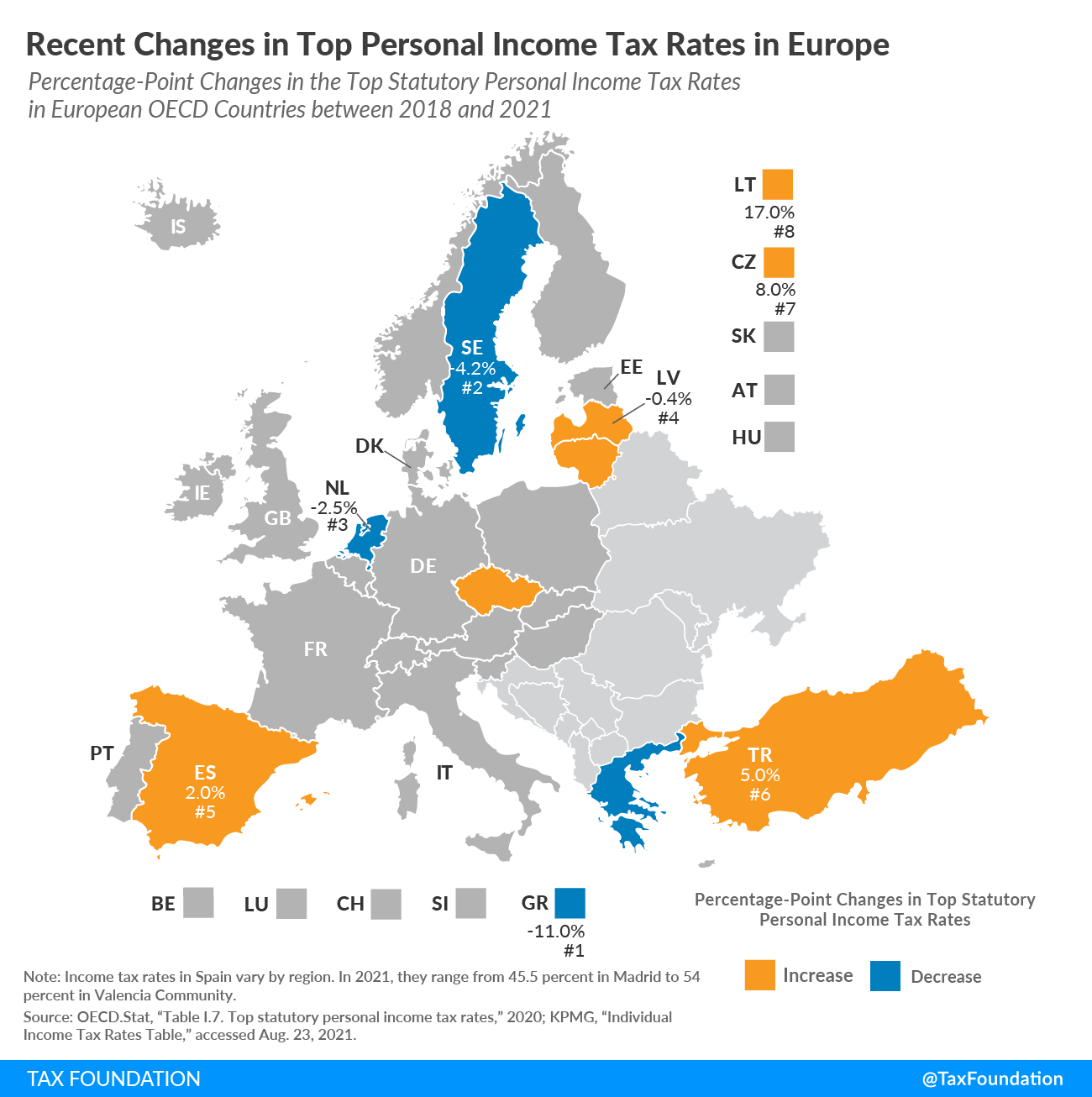

Between 2018 and 2021, eight European OECD countries changed their top personal income tax rates. Of these eight countries, four reduced their highest personal income tax rates while the other four increased their highest rates.

The Czech Republic, Latvia and Lithuania have moved from flat-rate personal income taxes to progressive tax structures. Spain has increased its highest personal income tax rate. Sweden has removed a surcharge. A surcharge in Greece has been temporarily suspended. The Netherlands have slightly changed their personal income tax rates. Turkey has added a new upper personal income tax bracket.

Czech Republic

From 2021, the Czech Republic reintroduced progressive taxation with a maximum rate of 23% on income above 1 million Czech crowns (US $ 78,000). Previously, a flat tax of 15 percent applied.

Greece

Greece reduced the top personal income tax tax rate from 55% to 54% (44% income tax plus 10% solidarity surcharge) in 2020. In 2021, the solidarity surcharge has been suspended for all types of income, other than income from public sector employment and pensions. . The maximum rate applies to income over 40,000 € (45,610 USD).

Latvia

In 2018, Latvia moved from a flat-rate personal income tax to a progressive tax. Prior to this change, Latvia applied a flat tax of 23%. The new system has three separate tranches, at 20%, 23% and 31% (31.4% before 2021). The maximum rate applies to income over € 62,800 (US $ 71,608) in 2021.

Lithuania

In 2019, Lithuania moved from a flat-rate personal income tax of 15% to a progressive income tax initially with two brackets with rates of 20% and 27%. The current maximum rate is now 32%. The top bracket applies to income over € 81,162 (US $ 92,545).

Netherlands

The progressive tax system in the Netherlands has gone from four brackets with a maximum personal income tax rate of 52% to three brackets with a maximum rate of 51.75% in 2019. The structure of the brackets has been further improved. amended in 2020, reducing the top personal income tax bracket. at 49.5%.

Spain

Spain has a decentralized fiscal system with personal tax rates that are a combination of national and regional policies. Madrid has the lowest combined personal income tax rate in the country: a local tax rate of 21% plus the current national tax rate of 24.5% gives a combined rate of 45.5 %. The highest rate is 54 percent in the Valencian Community. In 2020, the national rate rose from 22.5 to 24.5, increasing rates across the country.

Sweden

Sweden removed its highest personal income tax rate in 2020, which added a 5% surtax on income above SEK 703,000 (US $ 76,372). Sweden levies a 20% tax rate on income over SEK 523,200 (US $ 56,839) as well as a variable municipal tax rate. The current average municipal rate is 32.85%.

Turkey

In 2020, Turkey introduced a new personal income tax rate of 40% that applies to income above TRY 650,000 (US $ 92,527). The new rate has been added to Turkey’s tax brackets of 15, 20, 27 and 35 percent.

| Country | 2018 tax rate | 2019 tax rate | 2020 tax rate | 2021 tax rate |

|---|---|---|---|---|

| Czech Republic (CZ) | 15% | 15% | 15% | 23% |

| Greece (GR) | 55% | 55% | 54% | 44% |

| Latvia (LV) | 31.4% | 31.4% | 31.4% | 31% |

| Lithuania (LT) | 15% | 27% | 32% | 32% |

| Netherlands (NL) | 52% | 51.75% | 49.5% | 49.5% |

| Spain (ES) (Madrid) | 43.5% | 43.5% | 43.5% | 45.5% |

| Sweden (SE) | 57.1% | 57.2% | 52.3% | 52.9% |

| Turkey (TR) | 35.8% | 35.8% | 40.8% | 40.8% |

|

Note: Income tax rates in Spain vary by region. In 2021, they range from 45.5% in Madrid to 54% in the Valencian Community. Source: OCDE.Stat, “Table I.7. Highest personal income tax tax rates â€, 2020, https://stats.oecd.org/index.aspx?DataSetCode=TABLE_I7; KPMG, “Personal Income Tax Rate Table,†accessed 23 August 2021, https://home.kpmg/xx/en/home/services/tax/tax-tools-and-resources/tax- rates-online / individual-income-tax-rate-table.html. |

||||

Was this page useful for you?

Thank you!

The Tax Foundation works hard to provide insightful analysis of tax policy. Our work depends on the support of members of the public like you. Would you consider contributing to our work?

Contribute to the Tax Foundation

Let us know how we can better serve you!

We are working hard to make our analysis as useful as possible. Would you consider telling us more about how we can do better?

Give us your feedback